Financial Plan Summary

My Financial Plan Summary (MFPS) consists of tables, charts and graphs that align your existing accounts, including life insurance policy, structured deposit and unit-trust from insurance companies, banks and investment houses, in a systematic fashion for financial analysis.

MFPS delivers several facets of Personal Financial Planning, i.e. in relation to life insurance planning concept, or simply Risk Management and Wealth Accumulation. In itself alone, MPFS does not represent a full fledge Personal Financial Plan which encompasses other aspects such as tax planning and estate planning. However, MPFS is a essential tool if you are re-engineering your existing programs for now and the future.

it is my sheer pleasure to prepare a MFPS for some of my privileged clients. And the purpose of this writing is to aid understanding for the various sections as well as their respective implication and application.

2 driving objectives of My Financial Plan Summary (MFPS):

1. In view of Risk Management

To determine the level of financial security in place for unforeseen life eventualities

2. In view of Wealth Accumulation

To estimate the amount of potential saving for emergency, education and retirement

Using the above-mentioned as underlying design factors for MFPS, the initial layout was created when i was 3 months old Prudential Adviser.

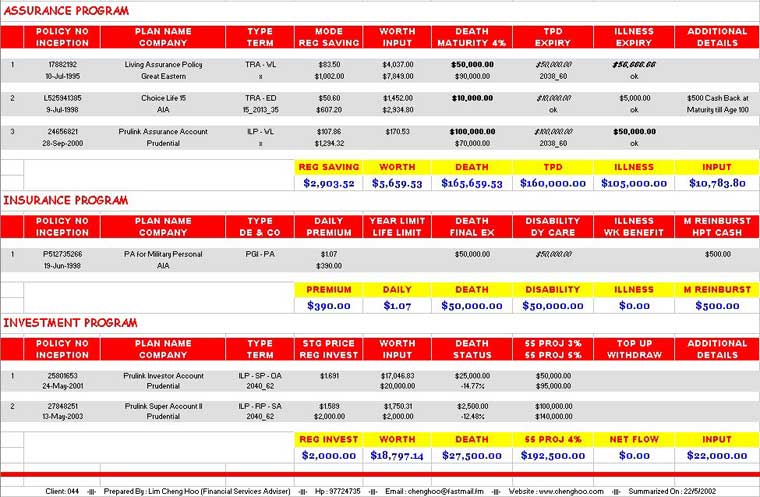

FIGURE 1: This is the First Release of My Financial Plan Summary in 2002

Although the template in FIGURE 1 is far obsolete by now, it provides the basic framework for a series of follow-up enhancements.

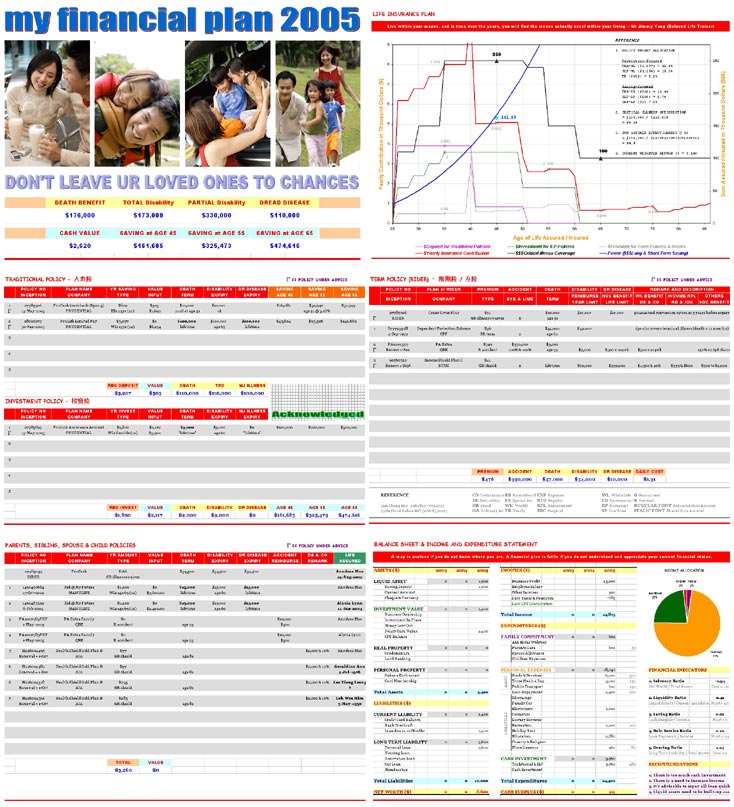

FIGURE 2: This is the Current Release of My Financial Plan Summary in 2005

MFPS is put together by 7 distinct but inter-connected sections, i.e. the Overview, the Program Tables and the Forecast.

- Overview of Risk Management & Wealth Accumulation

- Life Insurance Planning of One's Lifetime

- Traditional Policy and Investment Policy

- Term Policy and Supplementary Benefit (Rider)

- Policies acquired for Beloved Family Members

- Balance Sheet & Income and Expenditure Statement

- Designated Protection and Provision Schedule (coming up...)

The Overview is a consolidation of the 3 Program Tables, summing up all policies in a nutshell on a single page.

The sooner we realize the financial burden that we carry, whether it is for our children's education or housing loan, we know that most of us can't afford to die too soon and virtually all of us can't afford to be critically ill. Hence, FIGURE 3 below summarized the key securities which we have acquired just in case the unpredictable happens.

FIGURE 3: A Summary of Your Financial Securities in term of Risk Management and Wealth Accumulation

In Risk Management, there are 3 common areas of protection:

1. Family Income Protection (FIP), a preventive measure for "pre-matured" death or dying too soon

2. Physical Disability Protection (PDP), which includes both total disability and partial disability

3. Major Illness Protection (MIP), which includes both critical illness and hospital & surgical policy

Details for Hospital & Surgical Policy (H&S) are found on the 3rd Program Tables in MFPS.

Total Permanent Disability (TPD) benefit is normally found attached with whole life and endowment policies. To qualify for TPD, it means the losing of either two of the eyes or limbs or one each. As for partial disability benefit, it is normally found in Personal Accident Policy. Therefore, the loss of an arm or an elbow or the wrist is not claimable under TPD but it is claimable, from 50% to 100%, under Accident as the cause of partial disability.

Major Illness Protection (MIP) is what majority of the people emphasize the most. Perhaps, due to advancement in medical science, many patients eventual recovered from their sickness, leaving behind nothing but debts. Claims under MIP can be made upon diagnosis of critical illness as well as for the money spent in the course treatment.

In Wealth Accumulation, there are 3 common areas of provision:

1. Emergency Fund, i.e. a short term saving

2. Education Fund i.e. a medium term saving

3. Retirement Fund, i.e. a long term saving

In FIGURE 3, which is also the bottom half of the Overview section, it gives you the total cash value of all policies and the projected saving at age 45, 55 and 65. The total cash value is the sum of current cash values of all existing policies. The projected savings are sums of extracted figures from the quotations of each policy at the respective ages.

All 12 numbers found in FIGURE 3 are consolidated collectively from the 3 Program Tables, they are the Assurance Program Table, the Investment Program Table and the Insurance Program Table.

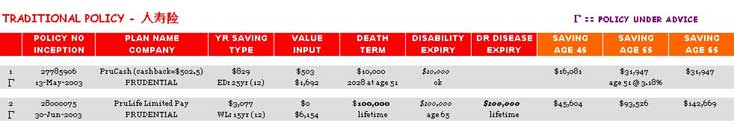

FIGURE 4: Table for Assurance Programs (Traditional Whole Life and Endowment)

FIGURE 5: Table for Investment Programs (Structured Deposit and Unit Trust)

Policies fall under the Assurance Programs (TRA) or the Investment Programs (ILP) are assets. Unlike the clothing, travel package and beauty services, assets form part of one's net worth. In another word, they are one form of money. Entries in these two tables are added along the 3 projected saving/return columns on the right hand side at the respective age of 45, 55 and 65.

It is also useful to note the significance of TYPE and TERM. The former indicates the type of plan (TRA-WL or TRA-ED) and the expected length of which the deposit is required (> 25yr or > age 85) whereas the latter specifies the contractual term of coverage for whole life (WL) or the maturity year and age for endowment (ED). The expiry ages for TPD and MJ ILLNESS are individually made known.

To paint a complete picture, the type of font used, whether it is bold or italic, it gives a different meaning to the sum assured. Regular font suggests that the amount is a standalone basic sum assured whereas italic font points out that it is a shared amount with the basic sum assured. Bold font means the sum assured will last a lifetime with no end to the coverage.

Investment Programs can be broadly classified into either a lump-sum investment (SP) or a regular-basis investment (RP).

FIGURE 6: Table for Insurance Programs (Term Policy, Rider, Personal Accident, H&S)

Every dollar of premium you pay for your Insurance Programs is strictly an expenditure. It is just like paying for car or travel insurance which does not accumulate cash value. Good examples of Insurance Programs are personal accident and MediShield.

Additional effort has been consumed in separating the riders or supplementary benefits from whole life and endowment policies. As a result, you will be able to appreciate the minor but costly components such as decreasing term or lady benefits hidden behind your assurance policies.

Due to the yearly renewable nature of Insurance Programs, the age limit of renewability and whether or not the policy is Guaranteed Renewable (GR) may be a concern to some people. This information is also specified by TYPE and TERM as well. As for the premium rates, generally, they are subjected to review or increases with age bands.

Last but not least, in order to understand the Program Table better, certain amount of basic understanding in different types of Insurance Programs such as personal accident and hospital & surgical policy are required.

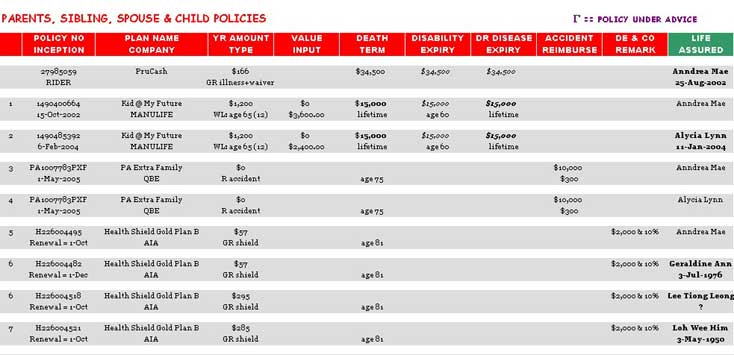

FIGURE 7: Table for Assurance / Investment / Insurance for Son and Daughter

Policies which you have acquired for spouse or son and daughter are singled out from those policies whereby you are the life assured. With this differentiation, it ensures the accuracy in your Risk Management summarized in the Overview section. Figures there-in are automatically calculated with each entry made under the Program Tables.

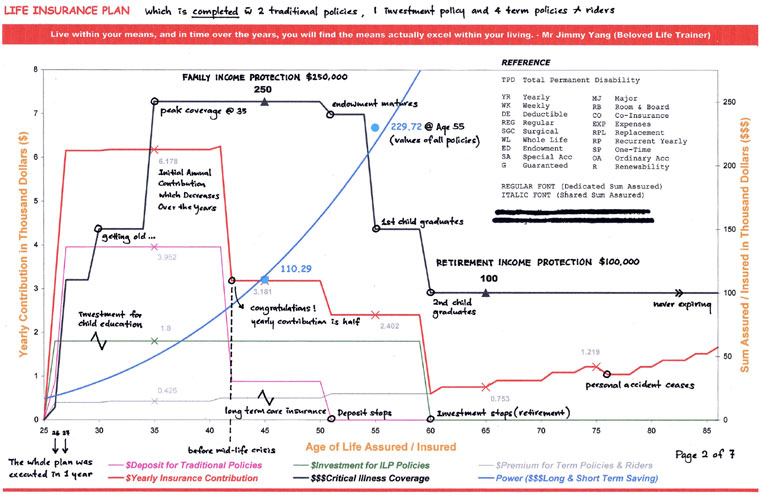

FIGURE 9: Forecast of Assurance Deposit, Investment Dollar and Insurance Premium

This is one of the optional analysis.

For some people, they are passive in the building up of their programs. They wait for advisers to call them, if they happen to be free and actually convinced with the right plan for the right budget; they will go ahead with the plan. These people let thing takes its own course.

Fortunately for most people they are pretty active in the quest of their programs. At the very least, they appear to know what they wanted; and on top of waiting for the right advisers to call, they might even look for advisers from different companies before they make a decision.

A small percentage of these active people, they have planned according to their best knowledge in knowing how many more policies and when they are going to acquire them. These people are real planners for themselves. They understand that with the limited budget they are having, every policies committed is going to place a limit on the next one they are acquiring.

It is for this last group of people I have developed this analysis with deposit/premium, sum assured/insured and projected saving/return plotted against time. The effect of time is accounted in the programming. These people, like myself, do not like surprises because they are not pro in handling un-anticipated events.